Instant Lending is the service that allows Banks to provide real-time financing through a fully digital process, either via website or branch terminal. It includes the digital onboarding of the Customer and the instant calculation of credit scoring.

The Instant Lending service maximizes the efficiency of the financing disbursement process.

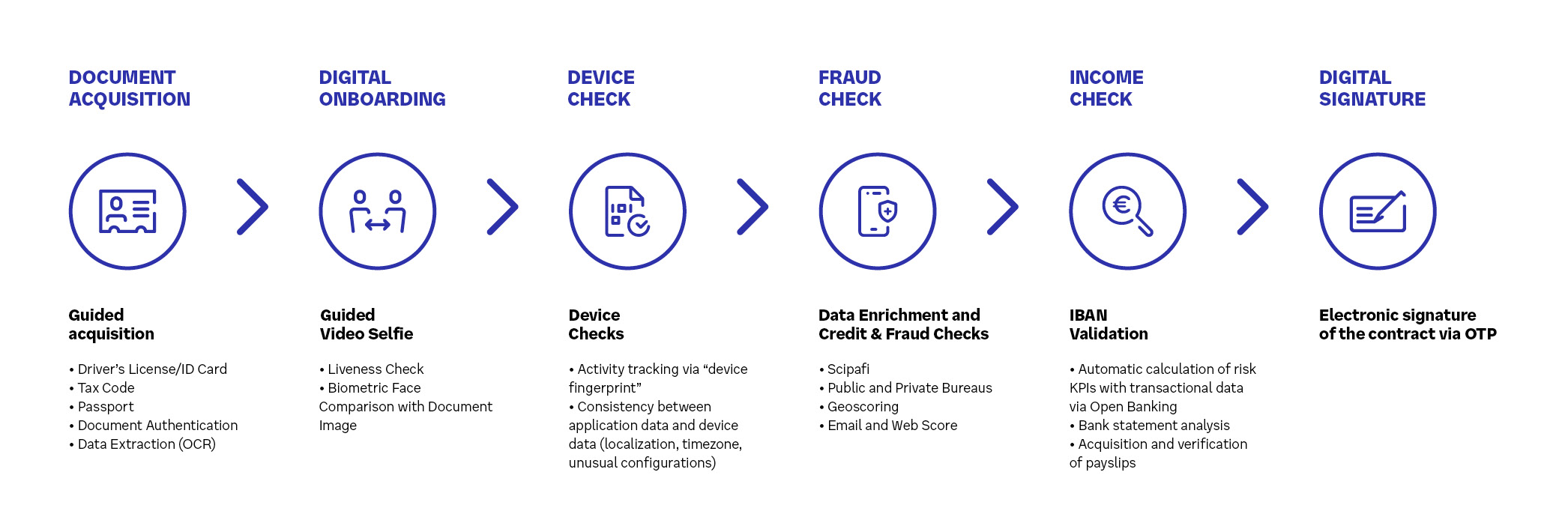

The service enables Banks to offer new credit to Customers and Prospects immediately, through a digital process, covering the following phases:

- Document acquisition: guided acquisition and authentication of documents that identify the user (e.g. Tax Code, ID, Passport, etc.)

- Digital identification: video verification of the authenticity of the acquired document by comparing the biometric facial features with the image on the document.

- Device-check: tracking the reliability of the device being used and verifying the consistency between the financing application data and the terminal data (e.g. geolocation, timezone, etc.)

- Fraud-check: automatic checks in industry databases (e.g. Scipafi) and Public Bureaus to prevent fraud

- Financial check: calculation of credit scoring (Open Risk), analysis of the bank statement and payslip, and verification of the correctness of the provided IBAN (Check Iban+)

- Digital Signature: acceptance and electronic signing of the contract via OTP

What the benefits are

- Accelerated loan disbursement process thanks to the automation and digitalization of the customer journey

- Reduced fraud risk through multiple identity and creditworthiness checks

- Minimized errors due to a fully paperless process

Why choose Nexi

Instant Lending, thanks to the collaboration between Nexi and Experian, is the safest and most effective service for instant loan disbursement. It offers an optimized journey with the Open Risk service to determine the customer's credit score, digital identification, and user reliability verification through data base checks.

Our partner

Experian offers a unique combination of data and analytics systems and provides solutions and services throughout the credit lifecycle for credit risk and fraud prevention.

Would you like to receive details about Instant Lending?

Fill out the form with all the necessary information, and we will get back to you as soon as possible.